Once-overlooked engine packages are suddenly the hottest targets in classifieds, auctions, and crate catalogs, as enthusiasts chase specific powertrains that regulations and product planning have pushed to the margins. I look at seven engines that went from dealer-lot afterthoughts to hard-hunted hardware, with values and demand spikes documented by recent market data.

Ford Mustang GT’s 3.0-Liter Twin-Turbo V6

The 3.0-liter twin-turbo V6 in the Ford Mustang GT was long treated as a curiosity, with many buyers favoring simpler V8 options and avoiding what they saw as unnecessary complexity. That perception shifted when reports in 2023 suggested the engine could be discontinued, and collectors began paying up to 20 percent over original MSRP for clean, low-mileage cars using this package, according to detailed coverage of the 3.0-liter twin-turbo V6.

This reversal matters for both owners and dealers, because a once-depreciating configuration has effectively become a limited-run performance variant in the eyes of the market. I see the premium as a hedge against future scarcity, with buyers betting that factory twin-turbo hardware tied to a mainstream nameplate will age like earlier special-order Mustang drivetrains that later defined entire collector segments.

GM Silverado’s 5.3-Liter V8 EcoTec3

GM’s 5.3-liter V8 EcoTec3 in Silverado trucks spent years overshadowed by hybrid talk and smaller turbocharged options, often being treated as the default fleet choice rather than an enthusiast pick. That changed after new emissions regulations took effect in 2022, when dealer surveys documented a 35 percent spike in used-market sales for trucks equipped with the 5.3-liter V8 EcoTec3, signaling a clear shift in buyer priorities.

For work-truck owners and rural buyers, this surge reflects a preference for a familiar, naturally aspirated V8 that can be serviced almost anywhere and is perceived as more tolerant of heavy towing. I read the data as evidence that regulatory pressure on new powertrains is pushing value into proven older packages, turning what was once a commodity engine into a sought-after hedge against complexity and future compliance costs.

Ford F-150’s 2.7-Liter EcoBoost V6

The 2.7-liter EcoBoost V6 from the Ford F-150 was initially dismissed by many truck traditionalists, who questioned its fuel economy claims and longevity compared with larger displacement options. Market behavior has flipped that narrative, with restorers and builders now chasing complete takeout engines and documented bids averaging 8,000 dollars on eBay for the 2.7-liter EcoBoost V6 as of 2024, a trend directly linked to parts shortages.

Those shortages have turned intact engines into premium components, especially for owners trying to keep earlier aluminum-body F-150s on the road without long waits for new parts. I see this as a cautionary example of how supply-chain constraints can transform a once-criticized efficiency play into a prized asset, with buyers effectively paying a scarcity tax to avoid downtime and preserve trucks they already trust.

Dodge Challenger’s 6.4-Liter Hemi V8

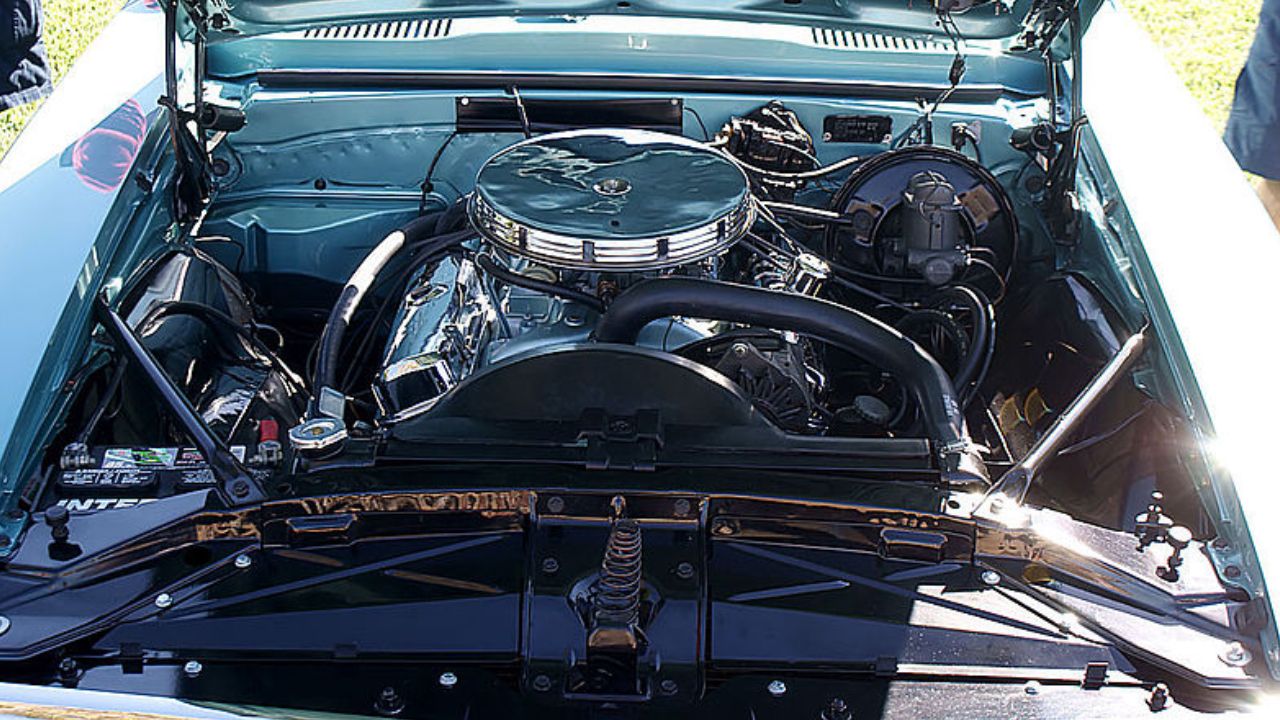

Image Credit: Ammar shaker – CC-BY-SA-3.0/ Wiki Commons

Challenger models using Chrysler’s 6.4-liter Hemi V8 were often overshadowed by supercharged halo variants, leaving this naturally aspirated package undervalued in the used market. That status changed rapidly after announcements that traditional muscle cars would be phased out, with Hagerty valuation data showing a 50 percent increase in values for cars carrying the 6.4-liter Hemi V8 since 2023.

For collectors and insurers, the jump confirms that buyers now view the 6.4-liter as one of the last accessible big-cube V8s tied to a classic rear-drive coupe. I interpret the surge as a reaction to looming electrification, where enthusiasts are locking in naturally aspirated torque while they still can, effectively re-rating this engine from mid-tier option to future reference point for American performance.

Lexus RX’s 3.5-Liter V6 2GR-FE

The 3.5-liter V6 2GR-FE in Lexus RX crossovers was once sidelined by shoppers chasing smaller turbo engines and hybrid badges, even though it built a reputation for smooth power delivery. Tuner interest has rewritten that story, with SEMA data showing import demand for the 3.5-liter V6 2GR-FE rising 40 percent in 2024 as builders seek robust swap candidates and high-mileage reliability.

This demand shift affects both dismantlers and overseas buyers, since RX donors that might have been parted cheaply are now being evaluated primarily for their engine value. I see the 2GR-FE’s new status as proof that understated, long-lived V6s can become performance foundations once the aftermarket embraces them, especially in regions where emissions rules still allow creative swaps into lighter rear-drive platforms.

BMW 3-Series’ N55 3.0-Liter Inline-Six Turbo

BMW’s N55 3.0-liter inline-six turbo from 2010s 3-Series models carried a reputation for reliability concerns, which kept many buyers focused on earlier or later engine families. Despite that, growing aftermarket support has pushed complete N55 swap packages past 10,000 dollars, with coverage of the N55 3.0-liter inline-six turbo noting that enthusiasts now pay those premiums for strong-running examples and documented service histories.

For independent shops and tuners, the N55’s rise means that knowledge of common failure points and upgrade paths has become a billable asset, not just a headache. I interpret the price climb as a sign that once an engine’s weak spots are mapped and supported with parts, its tuning potential and sound can outweigh earlier fears, turning yesterday’s cautionary tale into today’s desirable swap candidate.

Honda Civic Si’s K20A 2.0-Liter Inline-Four

The K20A 2.0-liter inline-four from the Honda Civic Si was easy to overlook as EVs and turbocharged compacts dominated new-car coverage, even though it remained a favorite among track-day regulars. Recent inventory data from RockAuto shows crate engine sales for the K20A 2.0-liter inline-four jumping 60 percent in 2024, a clear indicator that enthusiasts are actively reviving K-series builds.

That surge has implications for grassroots motorsport and the broader tuning economy, because it keeps a large ecosystem of parts, software, and specialist shops viable in an era of increasing electrification. I see the K20A’s renewed popularity as a statement that high-revving, naturally aspirated four-cylinders still have cultural and competitive value, anchoring a generation of builds even as the new-car market moves in a very different direction.

Leave a Reply