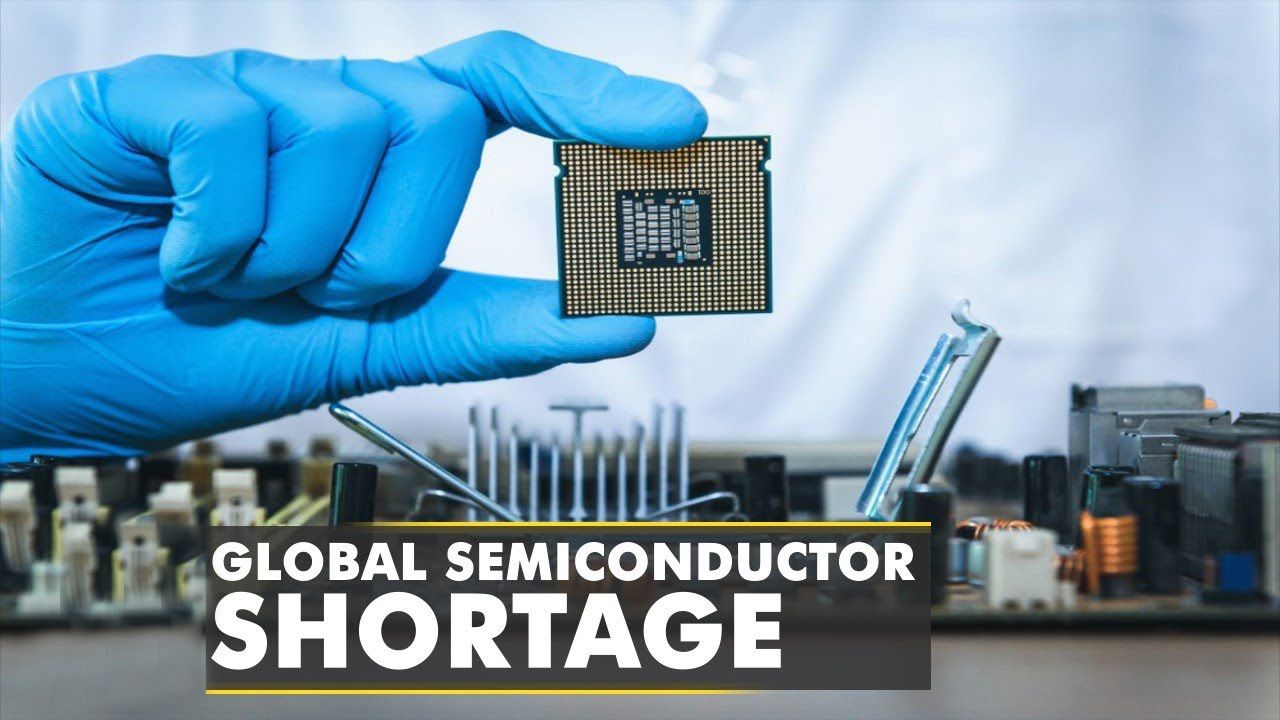

The global chip shortage, initially sparked by the COVID-19 pandemic, had a profound impact on various industries, with the automotive sector being one of the hardest hit. The scarcity of semiconductors disrupted new car sales, affecting everything from production timelines to consumer choices.

The Immediate Impact

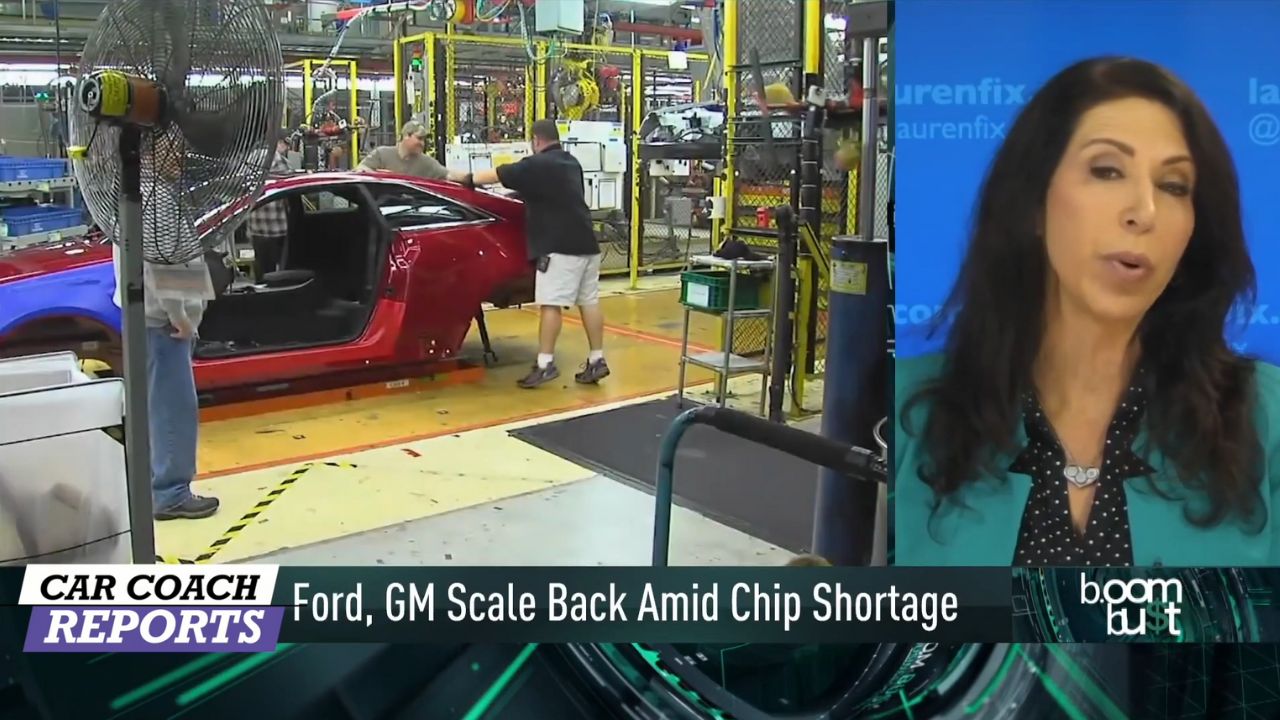

When the pandemic struck, automakers drastically scaled back production, expecting a sharp decline in vehicle demand. Meanwhile, consumer demand for electronics skyrocketed — laptops, tablets, and gaming consoles all competed for the same limited supply of chips. As factories reopened, automakers found themselves at the back of the line. The resulting shortages forced major brands like Ford, General Motors, and Toyota to pause assembly lines, delay new models, and deliver vehicles missing key features.

In some cases, partially completed cars sat in storage lots for months, waiting for a few missing chips before they could be shipped to dealers. Fleet buyers, such as rental companies, also struggled to replenish their inventories, adding pressure to both retail and used-car markets. The lack of supply reverberated across service networks, as repair shops and dealerships faced shortages of critical electronic components. What started as a temporary bottleneck quickly became one of the defining economic stories of the post-pandemic recovery.

The Ripple Effect on Dealerships and Consumers

Dealerships soon faced depleted inventories, driving vehicle prices to record highs. Popular models such as the Ford F-150, Toyota RAV4, and Honda CR-V became difficult to find, and wait times stretched for months. With fewer new vehicles available, many consumers turned to the used-car market, pushing secondhand prices up as well. The scarcity reshaped buying habits — pre-orders, reservations, and even online-only sales models became more common as customers sought to secure cars before they arrived.

Dealerships, once known for sprawling lots filled with hundreds of cars, suddenly became showrooms with only a handful of vehicles on display. Some retailers shifted their focus toward service and maintenance work, since new inventory was nearly impossible to replace. Buyers, in turn, became more willing to compromise on color, trim level, and options just to secure a vehicle. The traditional car-buying process — browsing, negotiating, and driving home the same day — became a rarity in many markets.

Industry Response and Adaptation

Automakers were forced to rethink production priorities, often focusing on higher-margin vehicles or those requiring fewer semiconductors. Some temporarily removed advanced options, such as digital instrument clusters or navigation systems, to keep production moving. At the same time, manufacturers began forging closer partnerships with chipmakers to improve forecasting and supply stability. The crisis also accelerated a push toward electric vehicles (EVs), which require even more semiconductors but offer a chance to modernize technology and diversify supply chains.

Companies like Tesla, which had built flexibility into their software and supply operations, adapted more easily than traditional automakers bound by long-term contracts. Industry leaders began to recognize that chip management had become as critical as steel or labor. Many brands also invested heavily in digital platforms and production tracking systems to predict shortfalls earlier. By necessity, automakers became more data-driven, viewing semiconductor sourcing as a strategic advantage rather than a background process.

Government and Global Action

Recognizing the economic threat, governments around the world intervened to strengthen domestic chip production. In the United States, the CHIPS and Science Act earmarked billions to build new semiconductor facilities and fund research aimed at reducing reliance on foreign suppliers. Similar programs emerged in Europe and Asia, marking a coordinated global effort to fortify a fragile supply chain that had proved too dependent on a few regions. These initiatives represented one of the largest industrial-policy shifts in decades, signaling that microchip manufacturing was now a matter of national security.

Countries competed to attract investment from companies like TSMC, Intel, and Samsung, offering tax breaks and subsidies to bring chipmaking closer to home. However, experts cautioned that building new fabs could take years, meaning short-term relief would remain elusive. The geopolitical dimension of the shortage — particularly tensions between the U.S. and China — added further urgency to the effort, as nations sought to safeguard access to advanced technology.

Long-Term Outlook

By 2023, signs of recovery had begun to appear, though production and inventories remained below pre-pandemic levels. The shortage exposed vulnerabilities but also sparked innovation — encouraging companies to diversify sourcing, improve transparency, and invest in technology. In hindsight, the crisis served as a wake-up call for an industry that had taken its global efficiency for granted. While the semiconductor supply chain may never be entirely risk-free, the lessons learned have laid the groundwork for a more resilient automotive future.

The push for regional production, better forecasting, and closer collaboration with chipmakers will likely shape how cars are built for years to come. Consumers, meanwhile, may continue to see streamlined inventories and more customized ordering processes rather than massive dealer lots. Automakers now understand that technology planning must be proactive, not reactive — and that flexibility is just as important as efficiency. In the long run, the industry that emerges from this disruption may be stronger, smarter, and far more adaptable than the one that entered it.

Like Fast Lane Only’s content? Be sure to follow us.

Here’s more from us:

*Created with AI assistance and editor review.

Leave a Reply