Dale Earnhardt Jr. has turned a clever sponsorship play into one of the most intriguing business stories in the garage, aligning JR Motorsports with a partner tied to a $4B Company that has already flirted with a Cup Series comeback. By locking in a fresh deal for 2026, he is not only strengthening his own program but also nudging the balance of power in a sponsorship market that Cup teams once treated as their private turf.

What looks on the surface like a standard primary sponsor announcement is, in reality, a strategic move that pulls a major brand’s focus toward the NASCAR O’Reilly Auto Parts Series and away from at least one Cup rival that had been courting the same dollars. In a landscape where every marketing contract is a referendum on value, Earnhardt Jr. has again shown that his name, his platform, and his timing still carry uncommon leverage.

How Earnhardt Jr. turned a sponsor hunt into a power play

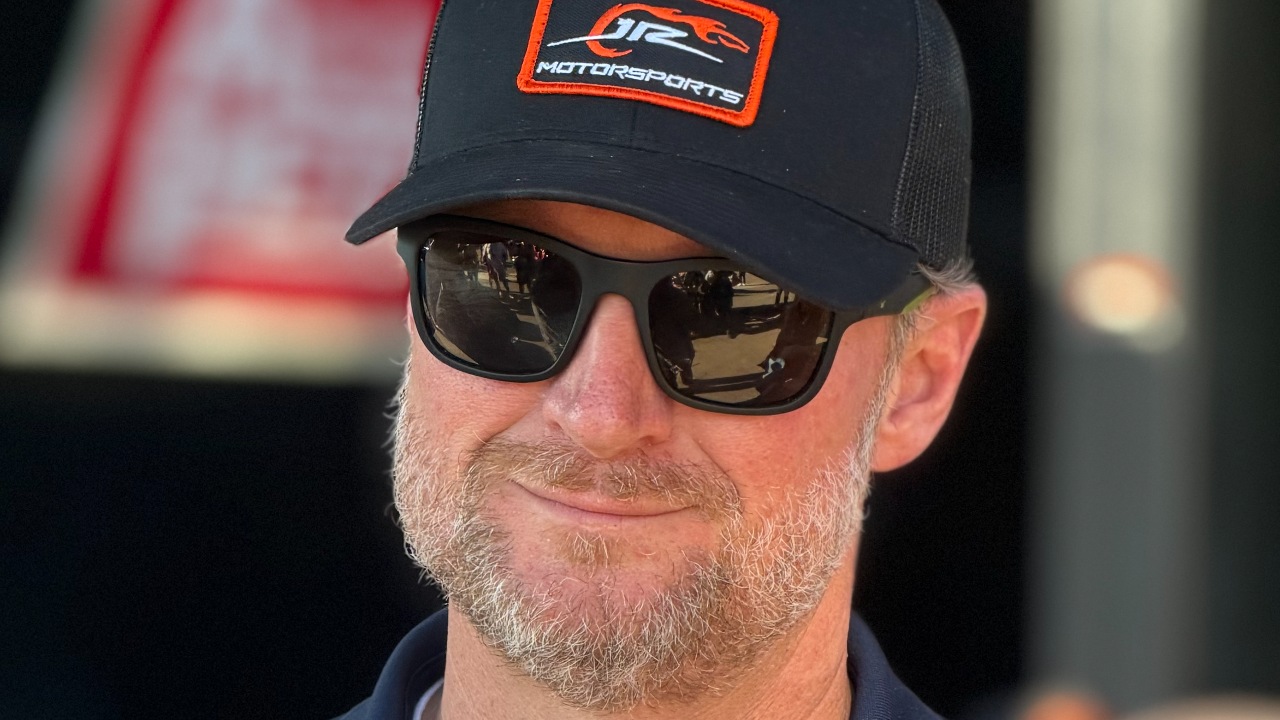

I see Earnhardt Jr.’s latest deal as the product of a long game rather than a one-off windfall. JR Motorsports has spent years building a reputation as the place where brands can get big-league visibility without paying the full freight of a Cup Series program, and the 2026 announcement fits that pattern. When JR Motorsports revealed a “mouth-watering” new sponsor for the upcoming season, the framing made clear that this was not just another logo on a hood but a centerpiece partnership designed to anchor the team’s commercial strategy for the next phase of its life in the NASCAR O’Reilly Auto Parts Series, a move that was highlighted in coverage of Dale Earnhardt Jr. and JR Motorsports.

The language around that reveal, including the emphasis on a “special partnership” for the 2026 season, underscored that this was not a short-term patch but a foundational deal. The report tied the announcement directly to Dale Earnhardt Jr., described as the driving force behind the agreement, and credited the move with setting up JR Motorsports for a run of high-visibility races that will be “unmissable” for fans and sponsors alike, a sentiment that was captured in the Story by Andrew Gould. The same reporting noted that the team’s ability to secure this level of backing reflects the enduring commercial pull of the Earnhardt name, a factor that still resonates across the sport even as the series itself transitions into a new sponsorship era, with the O’Reilly Auto Parts branding replacing Comcast’s consumer cable and wireless brand Xfinity.

The $4B Company connection and a Cup Series rival left wanting

The real twist in this story is the way Earnhardt Jr. has intersected with a $4B Company that had already been testing the waters for a Cup Series return. Earlier this year, an eleven times Grammy winning partner tied to Dale Jr. teased a renewed push in the Cup garage, with reporting explicitly describing it as a “$4B Company” weighing how to convert a Daytona gamble into a broader presence at the top level of the sport, a dynamic laid out in coverage of Dale Jr.’s Grammy winning partner and the Company. That same reporting framed the brand’s interest as a potential lifeline for Cup teams chasing fresh money, and it made clear that at least one organization saw this partner as a prime target for a long-term primary sponsorship.

By securing a headline deal for JR Motorsports that is linked to this $4B Company’s NASCAR ambitions, Earnhardt Jr. has effectively redirected a major marketing budget toward his own operation and away from a Cup rival that had been hoping to land the same backing. The coverage of the Grammy winning partner’s Cup flirtation described how the company’s executives evaluated the return on investment from their Daytona exposure, and how the success of that gamble strengthened their appetite for a deeper motorsports footprint, a process that was detailed in the Link Copied feature. When that appetite ultimately translated into a marquee partnership with JR Motorsports for 2026, the message to the Cup garage was unmistakable: Earnhardt Jr. can still outmaneuver full-time Cup teams when it comes to convincing blue-chip brands that his platform delivers better value, even if those teams race on Sundays.

Arby’s, JR Motorsports, and the new sponsor mix

Layered on top of the $4B Company connection is another telling piece of the puzzle, the decision by Arby’s to jump into the JR Motorsports ecosystem. The team confirmed that Arby’s has signed on for eight primary races along with a personal service agreement, a package that gives the fast food chain a consistent presence on track and direct access to Earnhardt Jr.’s star power, as spelled out in the NEWS that Arby has joined Motorsports. That structure is important, because it shows how JR Motorsports is stacking multiple sponsors in a way that spreads risk while still giving each brand meaningful exposure, a model that has become increasingly attractive as single-company season-long deals grow harder to secure.

The Arby’s agreement was further detailed in a separate report that described how the brand “Joins JRM As Sponsor,” complete with a Photo credit to Nigel Kinrade Photography and byline from Kevi, underscoring the visual and storytelling value the company expects to extract from the partnership, as highlighted in the Joins JRM As Sponsor coverage. That report emphasized that Arby’s is not just dabbling in a one-off paint scheme but committing to a meaningful slice of the schedule, which, when combined with the 2026 headliner deal tied to the $4B Company, gives JR Motorsports a diversified sponsor portfolio that many Cup teams would envy. In practical terms, it means Earnhardt Jr. can offer partners a menu of options, from multi-race primary deals to personal service agreements, all built around his own brand and the competitive platform of his cars.

Why the O’Reilly Auto Parts era amplifies this move

The timing of Earnhardt Jr.’s sponsorship coup is not accidental. The NASCAR O’Reilly Auto Parts Series is about to enter a new chapter, with O’Reilly Auto Parts taking over as the entitlement sponsor after a decade in which Comcast promoted its consumer cable and wireless brand Xfinity in that role, a shift documented in the Starting description of the series. That change matters because it resets the marketing narrative around the series, giving teams like JR Motorsports a fresh story to sell to brands that may have previously viewed the second tier as a secondary priority compared with the Cup Series. With O’Reilly Auto Parts investing in the series identity, the platform itself becomes more attractive to sponsors who want to be part of a revitalized property rather than a static one.

On top of that, the broader sponsorship environment has been shifting as well. Nascar has already shown a willingness to reconfigure its commercial relationships, replacing Xfinity with O’Reilly Auto Parts in a multi-year deal reportedly worth around US$15m per year, a figure that underscores the value the sanctioning body sees in the second-tier series, as reported in coverage of Nascar’s decision to move from Xfinity to Reilly Auto Parts and the associated Total. In that context, Earnhardt Jr.’s ability to bring a $4B Company and a national restaurant chain into JR Motorsports at the exact moment the series is rebranding looks less like coincidence and more like a calculated bet that the O’Reilly Auto Parts era will lift the entire property. By aligning his team with that momentum, he positions JR Motorsports as a flagship partner for the series’ new identity, which in turn makes it even harder for Cup rivals to lure those same sponsors away.

Legacy leverage: why brands still chase the Earnhardt name

Underpinning all of this is the simple fact that the Earnhardt name still carries a unique weight in American motorsports. Dale Earnhardt Jr. has spent years translating that legacy into a modern, media-savvy operation, from his ownership role at JR Motorsports to his presence in pop culture, including references that stretch as far as the Pixar universe, where Dale Earnhardt Inc appears as a Piston Cup related organization in Cars, a nod that reinforces how deeply the family’s racing identity is woven into mainstream entertainment, as noted in the Dale Earnhardt Inc entry. That kind of cultural reach gives sponsors confidence that their association with JR Motorsports will resonate beyond the core fan base, which is a crucial selling point when marketing departments are scrutinizing every dollar.

From my perspective, the 2026 sponsorship alignment shows how effectively Earnhardt Jr. has learned to convert that legacy into concrete business wins. The reporting around his “special partnership” for the upcoming season, the Arby’s commitment to eight primary races and a personal service agreement, and the $4B Company’s evolving NASCAR strategy all point to the same conclusion: brands believe that tying themselves to Dale Jr. and JR Motorsports offers a blend of heritage, reach, and value that is hard to match elsewhere in the paddock, as reflected in the coverage of JR Motorsports and the Arby sponsorship NEWS. In a sport where sponsorships can make or break competitive ambitions, that leverage is priceless, and it explains why a Cup Series rival has been left watching from the sidelines while Earnhardt Jr. walks into 2026 with a fortified balance sheet and a sponsor roster that looks more like a Cup powerhouse than a second-tier team.

Leave a Reply