Dale Earnhardt Jr. did not wait for lawyers and executives to finish their work before weighing in on the future of NASCAR’s charter system. As the long running dispute moved toward a settlement, he laid out what permanent charters could mean for team value, competitive balance, and his own path to the Cup Series.

His comments landed at a pivotal moment, just as the industry shifted from courtroom drama to a new economic reality that could reshape who gets to race on Sundays. I see his timing, and the substance of what he said, as a window into how one of the sport’s most influential voices expects the next era of NASCAR ownership to look.

Earnhardt Jr. warned what permanent charters would really change

Before the settlement dust even settled, Dale Earnhardt Jr. was already sketching out the consequences of turning NASCAR charters into permanent assets. He argued that if the system locks in guaranteed entries for current holders, the sport would move closer to a closed league model, with massive financial barriers for anyone trying to buy their way in. In his view, the charter is already more than a simple entry pass, and making it permanent would harden that reality.

He framed the issue in blunt economic terms, saying that, “If the charter remains nothing more than a guaranteed entry,” it still functions as a gatekeeper that shapes who can realistically compete at the top level. He then pushed further, suggesting that owners and executives “secretly” understand that permanent status would send charter prices “north of $150 million,” a figure that would instantly transform each slot on the grid into a high end franchise style property, according to his comments reported in If the.

He tied the settlement to a franchise style future

As the settlement came together, Earnhardt Jr. connected the outcome directly to a broader shift toward franchise style ownership. He said the agreement could be the moment when charters stop being treated as temporary licenses and start functioning like long term franchises that can be bought, sold, and leveraged as major assets. That framing matters, because it signals to investors and existing teams that the value of a charter is not just secure, it is poised to grow.

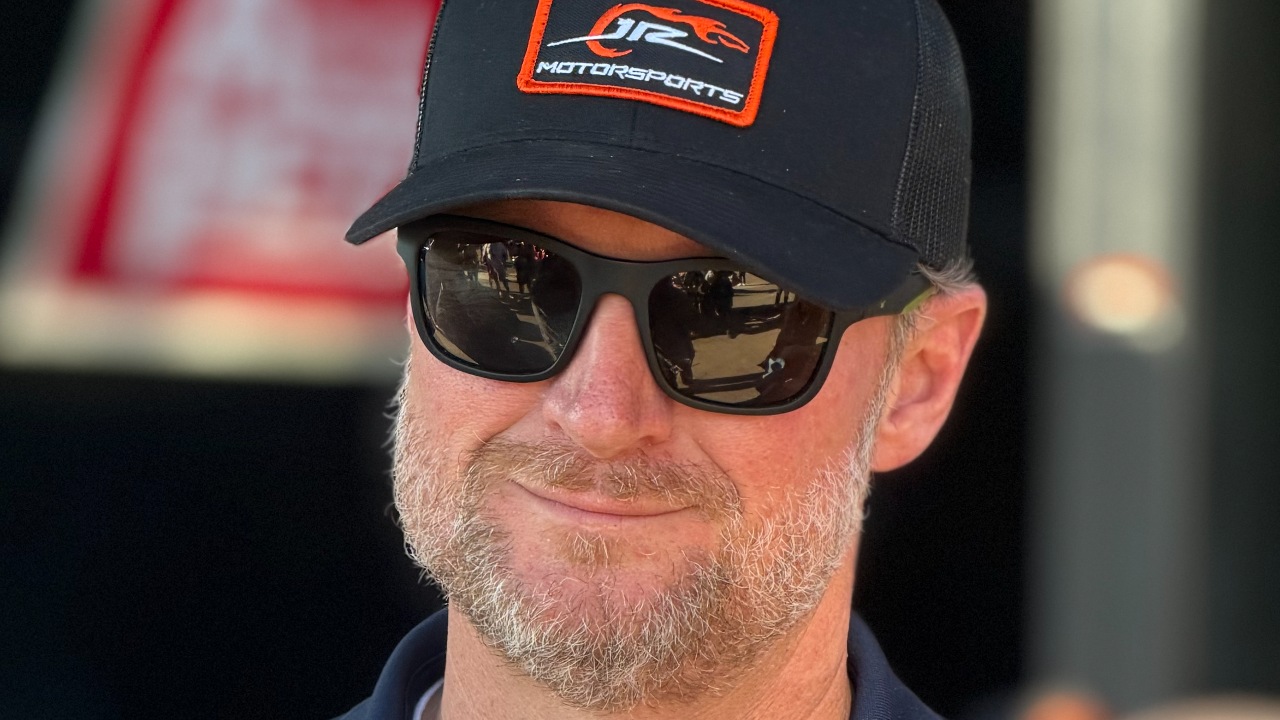

He pointed to the way the dispute had forced NASCAR and its teams to clarify what a charter really represents. Once the settlement locked in the system’s future, he argued, the market would respond by treating each charter as a scarce commodity with rising worth. He described how The Earnhardts, who own JR Motorsports and have long term ambitions in the Cup Series, see the settlement as a turning point that could send charter values climbing “tremendously” once the new structure is in place, a shift he linked to the broader move toward franchises and the significance of the “12.15” agreement milestone.

JR Motorsports’ Cup ambitions now face a steeper price

For Earnhardt Jr., the charter fight is not an abstract policy debate, it is a direct calculation about how and when JR Motorsports can step into the Cup Series. He has been open about wanting his organization to become a full time Cup entrant, but he also acknowledged that the window to buy in at a manageable price may have already closed. Earlier in the charter era, his group considered purchasing a slot when the cost was far lower, and he now admits that hesitation could prove expensive.

He recalled that his team looked at acquiring a charter in the system’s early days, when the buy in was still within reach for a successful Xfinity level operation. Instead, they waited, and the combination of on track success and the looming settlement helped push valuations higher. As he explained it, the new agreement means that any future move into the Cup Series for JR Motorsports will require navigating a marketplace where charters are treated as premium assets, a reality he underscored in comments about what the settlement means for him “entering Cup Series” that were detailed in Earnhardt.

The Earnhardts presented a united front during the dispute

Throughout the legal and political wrangling over charters, Earnhardt Jr. and his sister stood firmly on the same side of the debate. They watched the trial and negotiations closely, not just as commentators but as future stakeholders who will live with the consequences of any permanent system. Their alignment sent a clear signal that the family, which already has deep roots in NASCAR ownership, views the charter structure as central to the sport’s long term health.

He described the proceedings as “really compelling,” and he and his sister agreed that the case had forced every party to reveal its true position on power, revenue, and control. With the 2025 season in the rearview mirror, they focused on how the dispute, which involved figures such as Richa, would shape the next phase of team ownership. I read their shared stance as a message that any settlement needed to protect competitive integrity while still giving teams a meaningful stake in the business they help sustain.

He linked charter economics to the next generation of drivers

Earnhardt Jr. did not talk about charters in isolation from the racing itself. He repeatedly connected the financial structure to the opportunities available for young drivers trying to climb the ladder. In his mind, a system that locks in permanent, high priced charters risks narrowing the pipeline, because only organizations with deep resources will be able to field cars at the top level and take chances on emerging talent.

He pointed to examples from the track to illustrate what is at stake. In one recent season, Jesse Love ultimately beat all three drivers in a key battle by passing Zilisch, who had won 10 regular season races. Despite Zilisch dominating much of the year, the outcome showed how quickly fortunes can flip when a driver gets the right opportunity in the right equipment, a storyline highlighted in coverage of Jesse Love and Zilisch. Earnhardt Jr. has warned that if charters become permanent, ultra expensive assets, the open door tradition that allowed stories like that to unfold at the highest level could be lost, replaced by a grid where financial muscle matters more than raw potential.

Leave a Reply