Major U.S. and global automakers are no longer speaking in cautious generalities about Chinese competition. They are warning that China’s fast-rising car industry now represents a direct, immediate threat to the survival of large-scale auto manufacturing in the United States. The alarm is not about a distant future, but about a wave of low cost, tech heavy vehicles that executives say could upend the market if Washington does not act.

At the center of this warning is a simple message: if Chinese automakers gain unfettered access to North American consumers, the business model that has supported U.S. plants, suppliers, and union jobs for generations could unravel. The companies that once dominated the global car market are now asking the federal government to help them hold the line.

Automakers sound the alarm over a “clear and present” danger

Major automakers have shifted from quiet concern to explicit language that China is a “clear and present threat” to the U.S. auto industry. In coordinated outreach to policymakers, companies including GM, Toyota, Ford and others have warned that Chinese manufacturers are poised to flood global markets with aggressively priced vehicles, especially electric models, that traditional players will struggle to match on cost. In WASHINGTON, executives and lobbyists are telling lawmakers that this is not a cyclical downturn or a normal bout of competition, but a structural challenge that could permanently shrink U.S. production capacity if left unchecked, a message echoed in multiple accounts of GM, Toyota and Ford warning about China.

The language has been remarkably consistent. The Alliance for Automotive Innovation, which represents companies such as Ford, Toyota, VW and Hyundai and others, has told Congress that China’s state backed auto sector is using scale, subsidies and control over battery supply chains to build vehicles that can undercut U.S. rivals on price while matching or beating them on technology. In WASHINGTON, Major automakers have described China as a “clear and present threat” and a “clear and present danger” to the U.S. auto industry, urging lawmakers to recognize that a surge of vehicles from Chinese manufacturers would not be a normal import cycle but a destabilizing shock to domestic producers, as reflected in warnings from Major automakers, Investing and WNFL Spo.

China’s cost advantage and the BYD shock

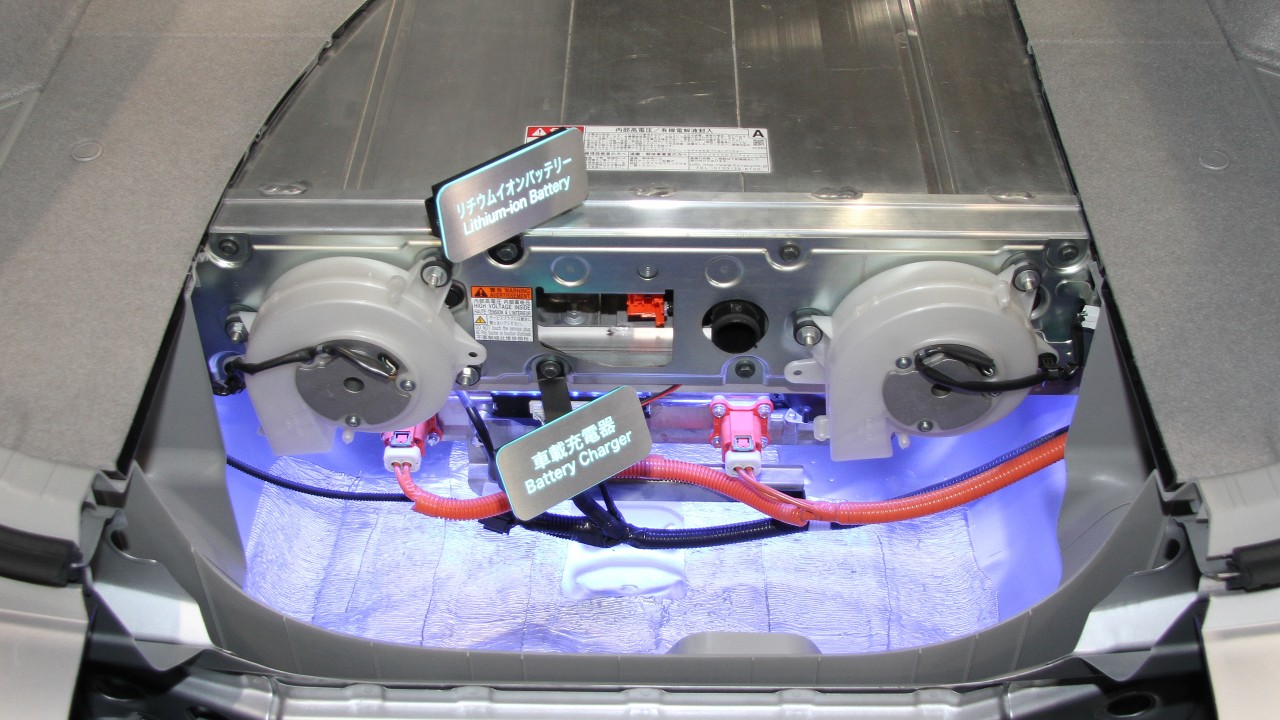

What makes China so formidable in this moment is not just volume, but the combination of low costs and increasingly sophisticated products. Chinese manufacturers have built dominant positions in batteries, critical minerals processing and EV component supply chains, allowing them to assemble electric vehicles at prices that Western rivals cannot easily match. In February, Chinese auto giant Build Your Dreams, better known as BYD, unveiled a fully electric crossover sport utility vehicle priced at a level that U.S. industry analysts said would “sell like hotcakes” if it reached American showrooms, a vivid example of how Chinese brands can pair competitive pricing with modern design and features, as detailed in research on Build Your Dreams (BYD).

For U.S. automakers already struggling to make money on electric vehicles, that kind of price point is alarming. Executives argue that Chinese companies benefit from direct and indirect state support, cheaper labor and a domestic market that has scaled EV production far faster than in the United States. Industry advocates say this combination creates a recipe for “dumping” vehicles into foreign markets at prices that do not reflect full production costs, a concern that has been explicitly raised in warnings that the current trajectory is “a recipe for dumping that Congress and the Trump Administration must prevent from happening inside the U.S.,” as one account of Major automakers put it.

Pressure campaign in Washington targeting Trump and Congress

In response, automakers are mounting an unusually direct lobbying push aimed at President Trump and Congress. The Alliance for Automotive Innovation and other industry groups have urged lawmakers to tighten barriers on vehicles, technology and services from China, arguing that existing tariffs and trade rules are not sufficient to address the scale of the threat. Automakers have pressed the Trump Administration and Congress to consider new tools that would limit imports of Chinese built cars, restrict the use of Chinese connected vehicle technology and scrutinize investment routes that could allow Chinese brands to enter the U.S. market indirectly, according to detailed accounts of Automakers press Trump administration, Congress.

One focal point is the U.S. Commerce Department’s role in policing automotive technology. Major automakers have urged lawmakers to maintain the Commerce Department’s prohibition on importing certain information and communications technology from China into U.S. vehicles, arguing that connected cars and over the air software updates create new national security and data privacy risks if Chinese systems are embedded in American fleets. At the same time, an Automaker group has warned Congress that China poses a threat to the U.S. auto industry and has called for policies that would prevent a surge of vehicles from Chinese manufacturers into the American market, as reflected in reporting on the Commerce Department and an Automaker group warns Congress. The industry’s message to Washington is blunt: without stronger trade and technology controls, they say, U.S. automakers will be competing on a tilted field.

Ford’s struggles and the risk of losing the EV race

The strategic anxiety is not abstract. Ford’s recent performance in key markets shows how quickly a legacy player can lose ground when it misjudges the pace of change. In one major market, Ford went from controlling over 60% of the market in 2020 to barely holding 30% by 2025, a collapse that underscores how vulnerable established brands can be when new competitors, including Chinese manufacturers, move faster on electric and connected vehicles. That kind of swing is not just a bad quarter, it is a warning about what could happen in the United States if domestic automakers fall further behind on cost and technology, a point driven home in analysis of Ford’s miserable state.

At the same time, the broader EV landscape in 2025 has been described as “the best of times” and “the worst of times,” with rapid innovation colliding with fierce price pressure and political backlash. Commentators note that those who “scream the loudest about the mythical ‘level playing field’ are those who fight the hardest to tilt the playing field in their favor,” a line that captures the tension between calls for open competition and demands for protection from Chinese imports. For U.S. automakers, the fear is that without some tilt of their own, they will be squeezed between high domestic costs and a flood of cheaper Chinese EVs, a dynamic explored in commentary on EVs 2025.

Debate over whether China is a threat or an opportunity

Not everyone accepts the framing of China as an existential menace. Some voices argue that China’s rising auto sector presents opportunities for collaboration, technology sharing and expanded markets rather than a one way threat. A commentary from China has pushed back on the U.S. industry’s rhetoric, noting that the Alliance for Automotive Innovation, representing GM, Ford, Toyota, VW, Hyundai and others, has been urging Washington to treat Chinese competition as a danger, while Chinese analysts insist that global supply chains and joint ventures can benefit both sides if politics do not shut the door. That perspective, laid out in a piece arguing that China’s rising auto sector presents opportunities, not a “threat,” highlights how differently the same dynamics are viewed in Beijing and Detroit, as seen in the response from the Alliance for Automotive Innovation coverage.

Even within the United States, there is an undercurrent of skepticism about how much protectionism can really help. Some analysts warn that trying to wall off the U.S. market from Chinese vehicles might slow the immediate shock but could also reduce pressure on domestic automakers to innovate and cut costs. Others argue that targeted measures, such as maintaining strict controls on Chinese connected vehicle technology and closing loopholes that might allow Chinese brands to route exports through third countries, are justified to prevent what Major automakers describe as a “clear and present threat” to long sustained American auto manufacturing, a phrase that has appeared in multiple warnings from Big automakers, Kyiv UNN and On December. The result is a policy debate that mirrors the industry’s own crossroads: whether to double down on global integration or to build higher walls around a domestic market that is no longer guaranteed to belong to U.S. brands.

Leave a Reply